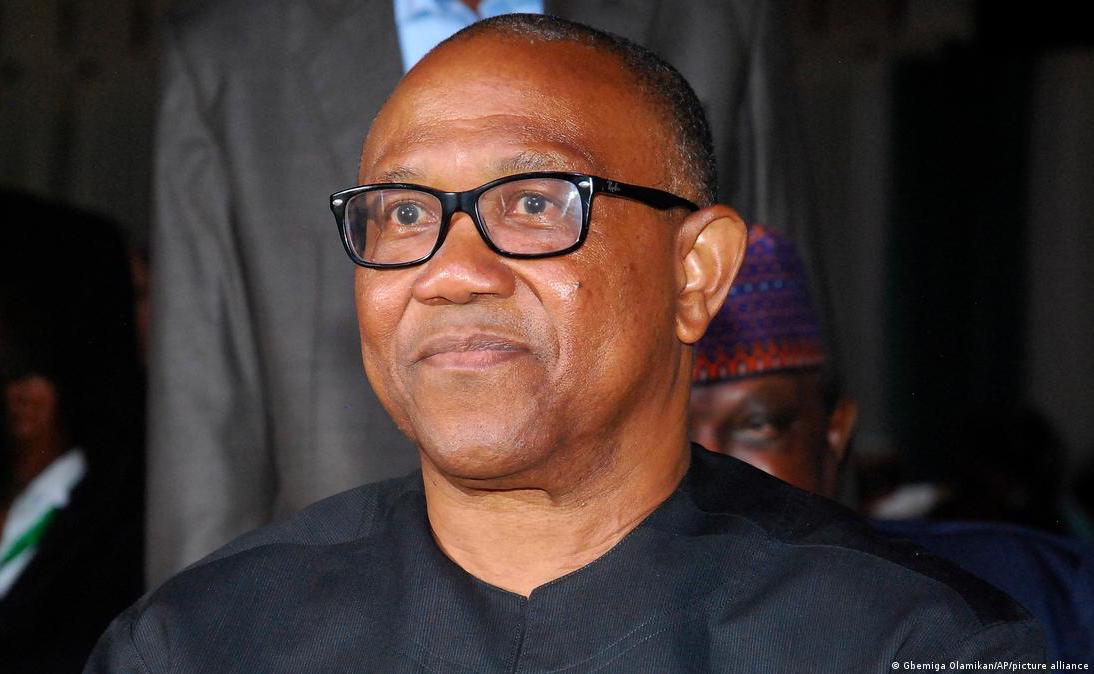

Former Anambra State governor and 2023 Labour Party presidential candidate, Peter Obi, has called on the Federal Government to immediately suspend the implementation of the newly introduced tax laws, warning that the reforms are riddled with serious flaws and lack public legitimacy.

In a statement issued on Tuesday, January 13, Obi said recent findings have made it clear that the tax laws were significantly altered and contain fundamental problems. He referenced a report by global accounting firm KPMG, which reportedly identified 31 critical issues in the laws, including drafting errors, policy contradictions and administrative gaps.

Obi argued that the scale of the concerns should prompt urgent action from the government, describing it as troubling that such deficiencies only emerged after private consultations between the National Revenue Service and KPMG.

“If experts require closed-door meetings to interpret our tax laws, what hope does the average Nigerian have of understanding the obligations being imposed on them?” he asked.

The former governor stressed that taxation is not merely a revenue-raising tool but a social contract between the state and its citizens. According to him, that contract cannot function where the laws are neither clearly understood nor trusted by the people.

Drawing comparisons with global best practices, Obi noted that tax systems in many countries are justified by visible public benefits such as quality healthcare, education, infrastructure, job creation and effective social safety nets. He argued that these benefits form the basis of citizens’ willingness to comply with tax obligations.

“In Nigeria, the emphasis appears to be on how much more the government can extract, rather than what it intends to give in return. A tax system without visible public benefits is not reform; it is extortion,” Obi said.

He further lamented the absence of broad consultations with key stakeholders, including businesses, workers and civil society groups, before the laws were introduced. According to him, such engagements usually take months or even years in other countries, ensuring that citizens understand both their obligations and the benefits attached to new tax measures.

Obi warned that the government has moved too quickly from legislation to enforcement without building consensus or providing clear explanations, even as Nigerians continue to grapple with the impact of fuel subsidy removal, rising food prices, high transport costs and declining purchasing power.

“Before addressing these challenges, Nigerians are being pushed into a sweeping new tax regime filled with inconsistencies and flagged with 31 major concerns by a leading global accounting firm. This is not responsible governance,” he said.

He concluded that taxation without trust feels like punishment, without clarity breeds confusion, and without visible public value amounts to robbery. Obi urged the Federal Government to halt the implementation of the tax laws, engage citizens openly and build national consensus as a prerequisite for genuine reform, economic growth and shared prosperity.